Potential Airdrop Expectation + High-Yield Staking, Taking Stock of the Top 10 New Projects Worth Watching Recently

Original Article Title: "Potential Airdrop Expectation + High-Yield Staking, Checklist of 10 New Projects Worth Watching Recently"

Original Article Author: CryptoLeo, Odaily Planet Daily

Life is not easy, and hodlers are crying. With the current market sentiment being tepid, it may be a good time to shift focus to new projects. Odaily Planet Daily has compiled a list of projects worth paying attention to recently, categorized into two main groups: DeFi and projects with recent funding announcements.

Friendly reminder: Participating in new projects involves certain risks. It is recommended to exercise risk management and due diligence. It is not advisable to invest a large amount of funds in the initial stages.

DeFi Category

1. Stout

Project Overview:

Stout is the native lending protocol on Sonic, with a current Total Value Locked (TVL) of $4 million. It is currently possible to borrow the protocol's stablecoin, DUSX, by providing wS, stS, wETH, veSTTX. The protocol consists of four tokens:

· STTX: Provides support for the protocol, equivalent to Stout's base token, with a token deflation and burn mechanism. Long-term holding is not recommended, and the best approach is to lock it as veSTTX;

· DUSX: Over-collateralized stablecoin, can be exchanged 1:1 with USDC through the protocol's PSM;

· veSTTX: Governance token and collateral asset, providing a 98% loan-to-value (LTV) ratio;

· stDUSX: Staking token, earning 75% of the protocol's revenue, with a staking APY of 24.47%.

When engaging in lending projects, it is important to pay attention to the project's liquidation threshold. On Stout, each collateral type has a different maximum ratio. Its liquidation mechanism involves when a Collateral Debt Position (CDP) reaches a collateral type's liquidation threshold, the user still repays the debt in exchange for some collateral.

Reasons to Watch: Part of Sonic ecosystem's DeFi protocol; high loan-to-value (LTV) ratio; stDUSX staking APY of 24.47%.

2. Dexari

Project Overview:

Dexari is a self-custodial, permissionless on-chain DEX built on Hyperliquid. It has launched an IOS Testflight version of the app (requires an invite code to join Early Access) and has already released features such as the contract market, token charting tool, and advanced orders. The project does not require KYC, supports multi-chain with unified cross-chain balances, and will soon introduce spot trading, fiat onramp/offramp, token tracking, and alert features. Additionally, Dexari will introduce staking and mining functions in the future. Early users can earn points in the Dexari Points Preseason to receive rewards after Early Access ends.

Reasons to Follow: Built on Hyperliquid with deep liquidity; App-based DEX that could potentially replace mobile CEX; Early access with rewards available, co-founded by Zac.hl, a former Binance.US employee.

3. flyingtulip

Project Overview:

flyingtulip is a one-stop DeFi platform launched by Andre Cronje, offering various functions such as trading, liquidity pools, and lending, all consolidated in a single AMM protocol. This setup eliminates liquidity fragmentation issues as it combines spot, leverage, and perpetual aspects in one protocol without the need to interact with different protocols. The official claim is that this product can reduce impermanent loss by 42%, increase LP returns by 9x, and enhance capital efficiency by 85% compared to other DEX protocols. For more details, refer to the article "The Man who Understands DeFi the Best, Bringing His New Project FlyingTulip."

Reasons to Follow: AC as the founder, 0.02% trading fee, 9x LP returns, and 85% capital efficiency.

4. Multipli.fi

Project Overview:

Multipli.fi is a multi-chain yield generation protocol with a TVL of $85.6 million. It is backed by Pantera Capital, Sequoia Capital, Elevation Capital, and The Spartan Group. The protocol utilizes a delta-neutral arbitrage strategy in the spot and futures markets to provide high yields for native tokens and RWA assets.

The project currently supports the BNB Chain and Ethereum, with deposits supporting USDT and USDC. In the future, it will support BTC, ETH, SOl, and other tokens. Users can deposit stablecoins into the project to earn high yields and ORB tokens (click the invite link to register, invitation code: 7T46G). Currently, the APY for USDC deposits is 21.19%, and for USDT, it is 21.21%. Deposits and ORB rewards take some time to complete. Bonus ORB rewards can only be received after depositing on Multipli.fi for 30 days. The first season (50% ORB weight) deposit ORB activity is almost over, and current deposits can participate in the second season (30% ORB weight) and the third season (20% ORB weight).

Reasons to Follow: High TVL, APY, and ORB token rewards, top-tier venture capital support.

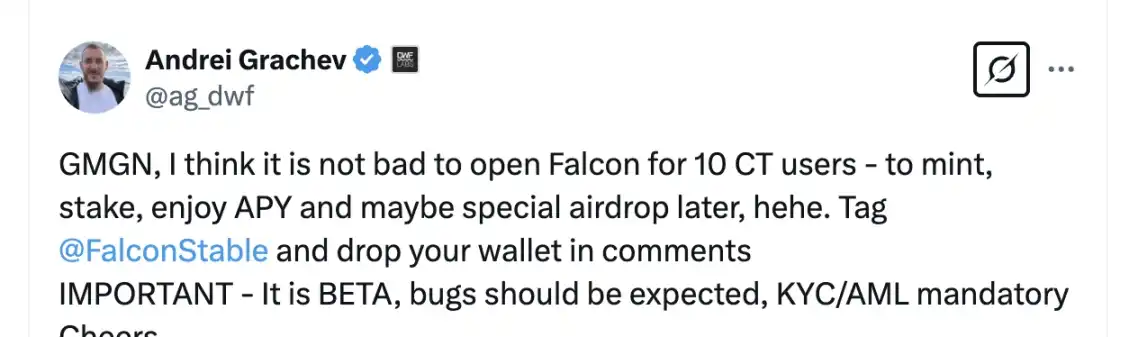

5. Falcon Finance

Project Overview:

A synthetic USD stablecoin protocol launched by DWF Labs partner Andrei Grachev, currently in the alpha testing phase. Participation requires application (follow their X account for periodic chances to qualify for alpha testing, early depositors enjoy high APY and potential airdrops). For more details, refer to "With an Annualized Yield of 22.6%, How Does Falcon Finance—Backed by DWF Partners—Achieve High Returns."

Reasons to Follow: TVL has exceeded $90 million ($92.1 million), and Andrei Grachev has hinted at possible future airdrops.

Recent Financing News

1. Mesh ($82 million)

Project Overview: Mesh is a company focused on crypto payments. For more details, refer to "With a Total Funding of $104 Million, Mesh Launches Crypto Payment 'New Infrastructure' Battle."

Reasons to Follow: Amid RWAfi's backdrop: high funding, participation of heavyweight investment institutions, and deep collaboration with PayPal's PYUSD.

2. RedotPay ($40 million)

Project Overview: RedotPay is also a project focused on cryptocurrency payments built by a Hong Kong team. It offers virtual and physical cards, supports ATMs, and accepts payments through QR codes, phone numbers, and RedotPay IDs. The project is backed by a Hong Kong-licensed trust and corporate services provider.

Reasons to Watch: Supported by Sequoia China and Lightspeed Venture Partners, strong focus on security and compliance, and provides fast and seamless payment experience. Launched the RedotPay Alliance Program, where members can enjoy a 40% transaction commission (calculated every 30 days).

3. Rain ($24.5 Million, Card-Issuing Business)

Project Overview:

Rain is a stablecoin-supported enterprise card issuer that offers custom debit, credit, and prepaid cards for businesses to issue B2B and consumer cards. These cards are directly linked to self-custody wallets, custodial solutions, or traditional fiat accounts. Cardholders can make payments without converting their cryptocurrency to government-issued currency. Rain has built stablecoin interoperability infrastructure across fiat currencies, supporting native settlements on multiple blockchain networks (such as Base, Polygon, Optimism, Avalanche, Arbitrum, ZKsync, and Solana) with transactions settled in stablecoins, currently covering over 100 countries globally.

Reasons to Watch: Led by Norwest Venture Partners, with participation from Lightspeed Venture Partners, Coinbase Ventures, among others. Sponsored and operated by Visa as a key member of the card project.

4. Yeet (Raised $7.75 Million Last Year, Announcement This Year)

Project Overview:

A crypto gaming platform led by Dragonfly with investments from Primitive Ventures and Mirana Ventures, supported by investors like the CEO of LayerZero and the CEO of Fat Penguin. A "crypto casino" founded by well-known figures in the crypto space, Michael Anderson (alias Mando), the anonymous trader Keyboard Monkey, and professional poker player Ben Lamb. Currently in the testing phase, users can join a waiting list. The known information includes the launch of several games in its beta version and the project's referral program, where users can not only profit directly from referrals but also earn from the referrals of those referred by their referrals, with a maximum of 3 levels of referral rewards.

Reasons for Attention: Dragonfly led the investment, the founder's professional background, and a significant 3-tiered referral reward.

5. Opinion Labs ($5 million)

Project Overview:

Opinion Labs is a prediction market platform with YZi Labs as the lead investor, also one of the top 4 performing projects in its MVB program. It has currently launched its Beta version, supporting the Monad testnet and Base network. Users can now register an account to receive USDO test tokens for trading operations, complete social tasks, or invite friends to earn points. Here is a referral code for registration: dfRAhCsx.

Reasons for Attention: YZi Labs led the investment, the Monad testnet is easy to use, there is an expectation of a token-based system or airdrop, and it can serve as an interactive project with no initial investment required.

Above are the new projects recommended this time. If you are interested, you can spend some time to continue monitoring or apply for early participation. Before the market heats up, the editor will continue to recommend new projects to everyone, hoping to earn additional profits in the future.

You may also like

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…

Investors Channel $258M into Crypto Startups Despite $2 Trillion Market Sell-Off

Key Takeaways: Investors pumped approximately $258 million into crypto startups in early February, highlighting continued support for blockchain-related…

NBA Star Giannis Antetokounmpo Becomes Shareholder in Prediction Market Kalshi

Key Takeaways: Giannis Antetokounmpo, the NBA’s two-time MVP, invests in the prediction market platform Kalshi as a shareholder.…

Arizona Home Invasion Targets $66 Million in Cryptocurrency: Two Teens Charged

Key Takeaways Two teenagers from California face serious felony charges for allegedly attempting to steal $66 million in…

El Salvador’s Bukele Approval Reaches Record 91.9% Despite Limited Bitcoin Use

Key Takeaways: El Salvador President Nayib Bukele enjoys a record high approval rating of 91.9% from his populace,…

Crypto Price Prediction for February 6: XRP, Dogecoin, and Shiba Inu’s Market Movements

Key Takeaways: The crypto market experienced a notable shift with Bitcoin’s significant surge, impacting altcoins like XRP, Dogecoin,…

China Restricts Unapproved Yuan-Pegged Stablecoins to Maintain Currency Stability

Key Takeaways: China’s central bank and seven government agencies have banned the issuance of yuan-pegged stablecoins abroad without…

Solana Price Prediction: $80 SOL Looks Scary – But Smart Money Just Signaled This Might Be the Bottom

Key Takeaways Despite Solana’s descent to $80, some traders find security as smart money enters the fray, suggesting…

XRP Price Prediction: Major Ledger Upgrade Quietly Activated – Why This Could Be the Most Bullish Signal Yet

Key Takeaways: The activation of the Permissioned Domains amendment on XRPL represents a significant development in XRP’s potential…

Dogecoin Price Prediction: Death Cross Confirmed as DOGE Falls Below $0.10 – Is DOGE Reaching Zero?

Key Takeaways The death cross event signals potential bearish trends for Dogecoin as its price dips under $0.10,…

Stablecoin Inflows Have Doubled to $98B Amid Selling Pressure

Key Takeaways Stablecoin inflows to crypto exchanges have surged to $98 billion, doubling previous levels amidst heightened market…

Coinbase UK Executive Declares Tokenised Collateral a Mainstream Financial Force

Key Takeaways Tokenised collateral is transitioning from its initial experimental stages into becoming core infrastructure within financial markets.…

Best Crypto to Buy Now February 6 – XRP, Solana, Bitcoin

Key Takeaways The cryptocurrency market witnesses volatility amid a technology-sector selloff, but opportunities still exist for keen investors.…

Why Is Crypto Down Today, February 6, 2026

Key Takeaways The global cryptocurrency market has seen an 8% decline in the last 24 hours, standing at…

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…

Investors Channel $258M into Crypto Startups Despite $2 Trillion Market Sell-Off

Key Takeaways: Investors pumped approximately $258 million into crypto startups in early February, highlighting continued support for blockchain-related…

Earn

Earn