From Decentralized Utopia to Speculator's Den, Why Has Capital Become the Ruler of Web3?

Original Article Title: Capitalism is killing the soul of web3 everyday

Original Article Author: hmalviya9, Founder of @dyorcryptoapp

Original Article Translation: Translated by Deep

Editor's Note: The article explores the process of Web3's decentralized ideal being gradually eroded by capitalism: initially established by freedom-seeking pioneers, Web3 attracted capitalists due to scarce block space like Bitcoin, then the expansion of new territories like Ethereum and technologies like Layer-2 caused block space to become saturated and value to decline; despite new lands emerging continuously, Web2 users hesitate to migrate due to complexity and risks, while exchanges, market makers, and other major players profit by manipulating the market, ultimately leading Web3 astray from its original purpose and becoming a capital-driven speculative playground.

Below is the original article content (restructured for better readability):

We inhabit two digital planets: Web2 and Web3.

The Web3 planet is quite novel — initially established by pioneers who believed in decentralization, freedom, and self-governance. In its early days, this was a wild, uncharted land with no rulers, only builders.

However, a bridge between Web2 and Web3 was later established. Initially, only a few capitalists from Web2 arrived, drawn by the raw potential of this new world. They stood on the sidelines, observing, analyzing the terrain, understanding the rules, identifying the most valuable territories.

The first large-scale colonization wave began with Bitcoin — the most precious nation on the Web3 island. This was scarce land with clear ownership, where power belonged to those who understood its fundamental principles.

But once the initial settlers took control and accumulated wealth, they began to expand. They realized that Web3 was more than just Bitcoin. There was vast uncharted land waiting to be shaped. Soon, they moved beyond Bitcoin, establishing new territories — Ethereum, Solana, Polkadot, and countless others.

As more land was discovered, the race to claim new nations intensified. Initially, block space was scarce. The earliest blockchains operated under strict constraints — each transaction required space, and space was limited. This scarcity gave block space immense value. Owning a small piece of block space meant having a place in the new digital economy. However, with increased competition, innovation followed.

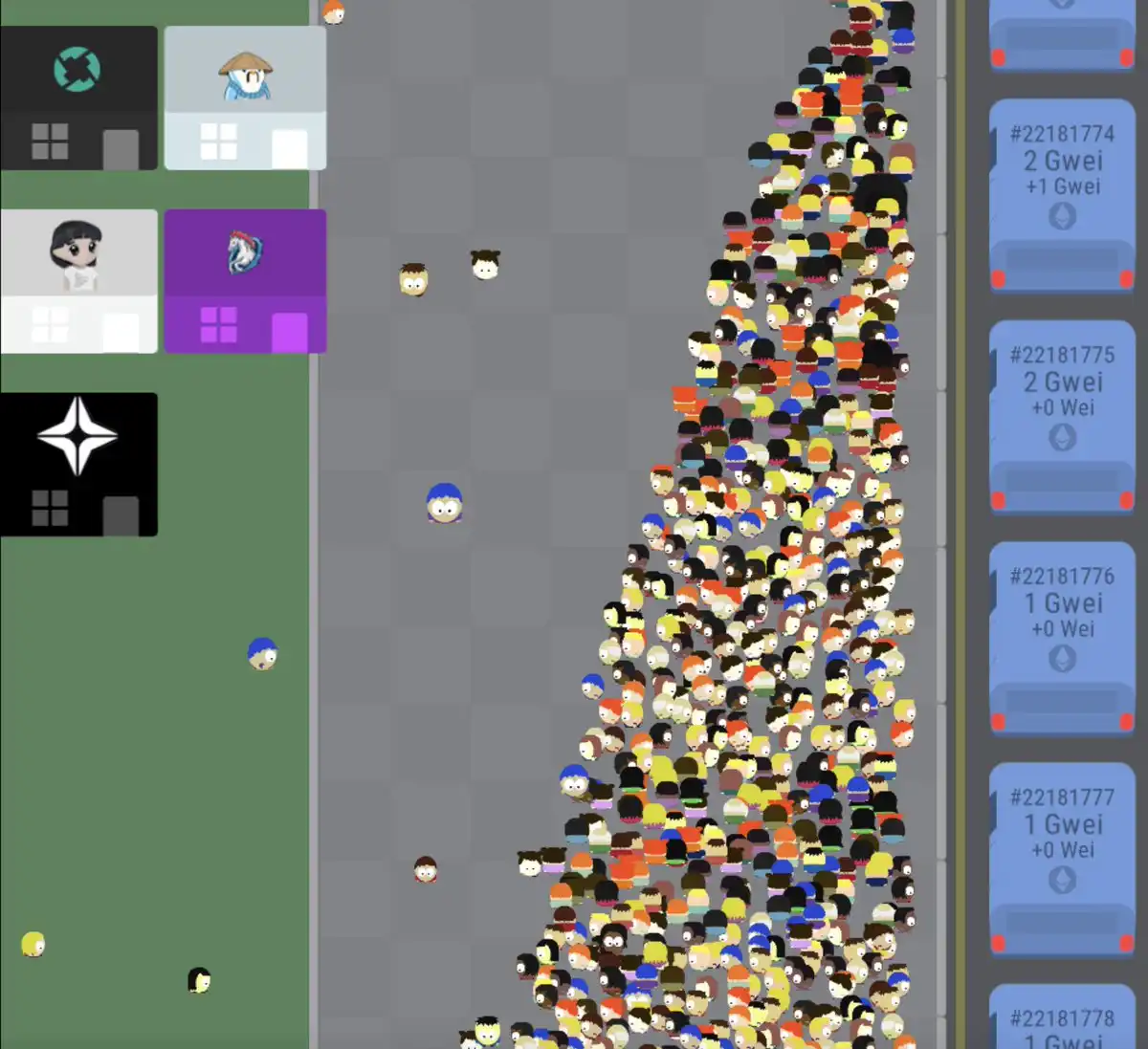

Ethereum Transaction Visualization

More efficient ways of creating block space emerged. Layer 2 solutions, Rollups, sidechains — each brought vast new lands to the Web3 planet. Goods that were once scarce became abundant.

Builders no longer fight for limited space; instead, they have created endless new land to meet the growing settlement demand. However, the proliferation of block space has brought unforeseen consequences.

Image Source: rollup.wtf

Once valuable things have become cheap. The cost of storing transactions — once a key economic force — has plummeted. The promise of cheap block space has attracted millions of Web2 settlers, but reality has proven otherwise.

People from Web2 hesitated.

They heard stories of adventurers entering Web3, lured by the promise of wealth, only to be devoured by predators. Some Web2 residents did take the step, drawn to the legend of overnight riches.

They entered Web3, hoping to carve out a place in the new economy. Many started by purchasing small plots of land — various tokens, each promising future value. They traded, speculated, and started businesses, believing they were in the early days of the next great revolution.

But they did not realize that Web3 had long been structured by the earliest settlers and the most powerful capitalists. While the rules of the game were not explicitly stated, those who controlled this land knew it well. As more Web2 people moved in, they unwittingly found themselves in a predicament. The complexity of Web3 is daunting.

There are too many new nations, each with its own rules, and scams disguised as opportunities abound. The big players control the flow of information, manipulate the market, inflate values, and pull the rug out from under unsuspecting settlers' feet.

The Web3 world has become a playground for those who know how to extract wealth from the ignorant. Even though block space is cheaper than ever, adoption remains slow. The dream of a mass migration from Web2 to Web3 is crumbling.

The new land promised a seamless user experience but never reached the level of familiarity and convenience that Web2 offered. The additional promise of quick rewards is not enough to impress people — Web2 individuals have seen too many compatriots get burned.

They watched as entire nations in Web3 rose and fell overnight, wealth changing hands in the blink of an eye. Ordinary people hesitated, unable to see through the chaos. However, in the turmoil, a thriving marketplace emerged.

Web3's real estate — tokens — became the lifeblood of its economy. Everything is up for sale. Every nation has its own assets, unique value, and promises for the future. The trading floor never closes, driven by speculation, manipulation, and greed.

Some countries experience temporary prosperity, only to decline as attention shifts. New land is minted daily, sold to the highest bidder for a quick flip profit. The cycle continues endlessly. And as settlers struggle, the true beneficiaries of Web3 thrive.

Bridge operators — exchanges — act as gatekeepers, controlling the flow of assets between Web2 and Web3.

In short: scammers scamming scammers.

They profit with each entry and exit. Market makers — the hidden force managing liquidity — ensure every transaction is watched and taxed. Developers build continuously, not always for innovation, but to create more sellable land. And what of the marketers? They weave stories, craft narratives, selling dreams to the next hopeful settlers.

The dark side of Web3 is that it is no longer truly decentralized. The early vision of a freely open digital frontier has been replaced by the harsh reality of capital.

The same forces that dominated Web2 have infiltrated Web3. They settle not just inhabit but reshape this planet to suit their needs. Thus, the Web3 world expands, becoming an endless frontier of digital land, speculation, and fleeting opportunities.

The dream of true decentralization still exists. Settlers continue to arrive, hoping to strike it rich, but in the end, most leave poorer than they arrived.

Meanwhile, those who hold the system continue to extract, build, and control, ensuring this planet remains shaped by them.

You may also like

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…

Investors Channel $258M into Crypto Startups Despite $2 Trillion Market Sell-Off

Key Takeaways: Investors pumped approximately $258 million into crypto startups in early February, highlighting continued support for blockchain-related…

NBA Star Giannis Antetokounmpo Becomes Shareholder in Prediction Market Kalshi

Key Takeaways: Giannis Antetokounmpo, the NBA’s two-time MVP, invests in the prediction market platform Kalshi as a shareholder.…

Arizona Home Invasion Targets $66 Million in Cryptocurrency: Two Teens Charged

Key Takeaways Two teenagers from California face serious felony charges for allegedly attempting to steal $66 million in…

El Salvador’s Bukele Approval Reaches Record 91.9% Despite Limited Bitcoin Use

Key Takeaways: El Salvador President Nayib Bukele enjoys a record high approval rating of 91.9% from his populace,…

Crypto Price Prediction for February 6: XRP, Dogecoin, and Shiba Inu’s Market Movements

Key Takeaways: The crypto market experienced a notable shift with Bitcoin’s significant surge, impacting altcoins like XRP, Dogecoin,…

China Restricts Unapproved Yuan-Pegged Stablecoins to Maintain Currency Stability

Key Takeaways: China’s central bank and seven government agencies have banned the issuance of yuan-pegged stablecoins abroad without…

Solana Price Prediction: $80 SOL Looks Scary – But Smart Money Just Signaled This Might Be the Bottom

Key Takeaways Despite Solana’s descent to $80, some traders find security as smart money enters the fray, suggesting…

XRP Price Prediction: Major Ledger Upgrade Quietly Activated – Why This Could Be the Most Bullish Signal Yet

Key Takeaways: The activation of the Permissioned Domains amendment on XRPL represents a significant development in XRP’s potential…

Dogecoin Price Prediction: Death Cross Confirmed as DOGE Falls Below $0.10 – Is DOGE Reaching Zero?

Key Takeaways The death cross event signals potential bearish trends for Dogecoin as its price dips under $0.10,…

Stablecoin Inflows Have Doubled to $98B Amid Selling Pressure

Key Takeaways Stablecoin inflows to crypto exchanges have surged to $98 billion, doubling previous levels amidst heightened market…

Coinbase UK Executive Declares Tokenised Collateral a Mainstream Financial Force

Key Takeaways Tokenised collateral is transitioning from its initial experimental stages into becoming core infrastructure within financial markets.…

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Earn

Earn